Our people

Hear from some of our people about what it’s like working at EDF Trading:

-

David Chantelou

Manager of the Optimisation and Trading Analytical Team (Paris)

-

Joel Tan

Head of Oil Origination (Singapore)

-

Aaron Woodley

Front Office Delivery Manager (London)

-

Erin Settegast

Product Control (Houston)

-

Karolina Potter

Head of European Pricing and Structuring (London)

-

Marina Lopez-Melgar

Head of Data Management (London)

We encourage learning & development

We are committed to not only welcoming candidates that best fit our company but those who have the potential to grow with us. We equip our employees with the tools that will enable them to fulfil their job to the highest standard. To that end we offer a wide range of technical and personal development courses both in-house and through third-party providers. We are committed to learning and being the best version of ourselves every day. It drives everything we do.

Our culture

We are proud of our ethnic and cultural diversity. We are high-performing people working together to achieve common goals. Innovative and flexible in our thinking, we are able to adapt and change, which is critical to our success. Respect is our foundation, it’s what empowers our employees to unlock their full potential. Our people are encouraged to speak up, and we listen, which drives collective understanding, collaboration and achievement.

Collaboration creates opportunity

Respect is our foundation

Entrepreneurship fuels innovation

Adaptability is our strength

Trust underpins our interactions

Excellence is our standard

Our values

Our values are crucial as they guide decision-making, shape the organisational culture and influence both employee engagement and customer trust, ultimately driving long-term success and sustainability.

Work benefits

We offer a comprehensive range of benefits which include a personal pension plan, medical and dental insurance, a biannual health assessment, season ticket loan, childcare vouchers, cycle to work scheme and eye test vouchers. We also have a number of social and teambuilding events during the year as well as seasonal parties.

Our benefits vary by region but here's a selection of what's on offer.

Finance

- Personal pension plan

- Season ticket loan

- Cycle to work scheme

- Childcare vouchers

- 6% non-elective bi-weekly contribution to employees' 401(k)

- Parking subsidy

Health

- Medical, dental and vision insurance for employees and dependents

- Employee Assistance Programmes

- Access to mental health apps

- Biannual health assessment

- Eye test vouchers

- Monthly massage therapist to Houston office

- Discounted massages for London office

Lifestyle

- Hybrid work model

- Career development opportunities

- Comprehensive learning offers

- Corporate gym membership rates

- On-site gym at Houston office

- Flu vaccinations

- Daily fruit delivery

- Volunteering programme with paid time off to volunteer

- Staff social events

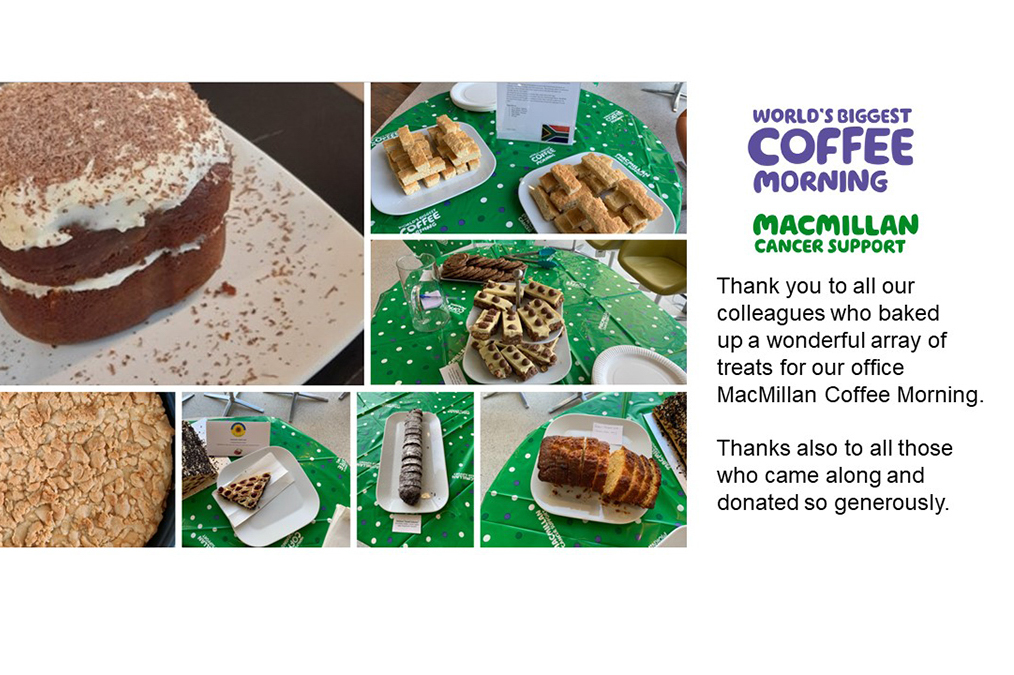

- Charity fundraising matching scheme

Our teams

We offer a variety of challenging roles from trading and origination through to IT, risk management and finance.

Learn MoreOur offices

Our offices are based in the busy hubs of Victoria, downtown Houston, Paris, Tokyo and Singapore where you’ll find plenty of spots for coffee, a bite to eat or lively evening activities with your friends and colleagues.

Opportunities to get involved

We strive to leave a positive mark on our local communities. We partner with organisations across our regions to give our time and talents to make a difference. We provide an additional vacation day solely for community service use and have a matching donation programme so you can support the charity organisation of your choice. There are also a number of events such as the JP Morgan Challenge or the Houston Rodeo where you have the opportunity to network with your colleagues because great things happen when we work together to build bonds and partnerships both at work and within the community.